Are you searching for a signal in the noise? If you are just starting your SaaS Management Platform (SMP) search, one of the best resources can be analyst research if you know what data is relevant.

The GigaOm Radar for SaaS Management Platforms has recently launched, providing a comprehensive analysis of the evolving SaaS management landscape today, the top vendors, how professionals can order their selection criteria, and the strengths and limitations of different vendors. This report is a crucial resource that will keep you informed and up-to-date in your SaaS Management Platform search.

Market Context: SaaS application adoption is (still) increasing as companies strive to achieve their digital transformation goals. SaaS applications now represent a significant portion of many organizations’ application inventories, much like what we’ve seen from Gartner’s Market Guide. This growth demands an integrated, data-driven operations model to effectively manage SaaS application spend, vendor sourcing, IT operations, and security compliance.

While research is valuable, the most empowering thing is understanding the SaaS Management offerings today and how they compare to your organization’s needs. This understanding will guide you in making the right decision for your organization.

Key Findings From the Report

1. Evolution of Full-Featured SMPs:

SMPs are rapidly evolving to combine SaaS Discovery, SaaS financial operations (SaaSFinOps), and SaaS operations (SaaSOps). These integrated capabilities allow platforms to deliver comprehensive visibility and functionalities and thus gain broader adoption than SMPs of the past.

The evolution also reflects more judicious app rationalization among IT teams as they consolidate their tech stack. As a result, SMPs that do not evolve into full-featured platforms risk becoming obsolete niche providers and point solutions.

2. Importance of Comprehensive SMPs:

Building on this theme, SMPs must provide comprehensive visibility and capabilities. At Torii, we have long championed the theme of the SMP as “software to manage software” without constraints. Now, this vision is becoming a reality with more powerful integrations and actions.

As SaaS dominates our software and cloud apps define our workspaces, managing those apps becomes more critical than ever while simultaneously requiring more nuanced and multi-dimensional tools.

Key Takeaway Summary: IT’s role is rapidly evolving, and so must the tools it uses to manage its tech stack. The SMPs that provide comprehensive visibility and actions will be well-positioned to support and enable organizations, while niche and point solutions will struggle to make the leap.

Decision Criteria Comparison

The report advises potential buyers to view SMPs based on their capabilities divided into three categories:

- Table Stakes: these are the “must-haves” for SaaS management. Vendors that fail to provide these basic capabilities will ultimately undermine their user’s ability to perform routine SaaS Management tasks. While these vendors may provide helpful point solutions, they lack the comprehensive capabilities necessary for SaaS Management.

- Key Features: Key features represent the differentiators between different vendors. This list is broader, and not every vendor excels with every feature.

- Emerging Features: These features are still in relative infancy and should be expected to become more mainstream within 12-18 months.

Table Stakes

Application discovery: The SMP identifies all SaaS applications used within the organization, providing a comprehensive view of the software landscape, including shadow IT, organized within a live repository. Typically, this insight is pulled from multiple sources, including expense information, IDP, SSO, primary integrations, etc. The breadth and depth of discovery are critical, as all automation and strategic decision-making are dependent on a solid foundation of discovery.

Application catalog: The SMP maintains an organized list of sanctioned applications from which employees can select or request access.

Usage tracking and analytics: Monitors and analyzes SaaS application usage, offering insights to optimize resource allocation and user engagement.

Application license management: Manages the allocation and usage of software licenses, ensuring compliance and cost efficiency.

Alerts: Provides real-time notifications for important events such as contract renewals, unauthorized access, license thresholds, and usage anomalies.

Key Features (Differentiators)

The report advises carefully considering the essential features made available by the vendor. Different platforms will have different strengths.

While a comprehensive solution is essential, so is a platform with the same priorities as your organization.

Integrations: pulls data from applications to provide insight and enables workflow actions to automate the SaaS lifecycle.

Sensitive data management: Monitors sensitive data storage and access, ensuring proper controls.

Spend management: Identifies cost-saving opportunities by optimizing license usage, comparing redundant apps, recommending the closure of unused apps, and consolidating capabilities. The platform enables streamlined coordination between finance and IT through these spend management capabilities.

Contract renewal management: Provides visibility into contract terms, alerts for upcoming renewals, usage data for critical insight for contract negotiations, and workflows to enable smoother cross-functional work between IT and Procurement.

User access and license management: Automates user lifecycle events like access requests, approvals, onboarding, and offboarding. Some systems will also offer more nuanced capabilities around events such as parental leave, job transitions, etc.

Insights and predictive analytics: Offers insights and future trend predictions based on usage data.

Governance support: Ensures compliance with internal policies and external regulations for SaaS usage.

User engagement capabilities: Provides intuitive methods for users to request access and perform tasks using familiar tools.

Emerging Features (Vision-setting)

The emerging features are just now entering the fray for most platforms and represent the direction of SaaS Management going forward. Features include AI features leveraging natural language processing (NLP, often through an LLM), security operations, and even MDM support as SaaS also starts to encompass local software.

Summary of Decision Criteria

Features are fickle. Different vendors offer different features to different degrees. The most important thing is to understand the “must-haves” and the key features that matter most. From there, the emerging features can further indicate whether the SMP is trending in the right direction.

GigaOm Radar

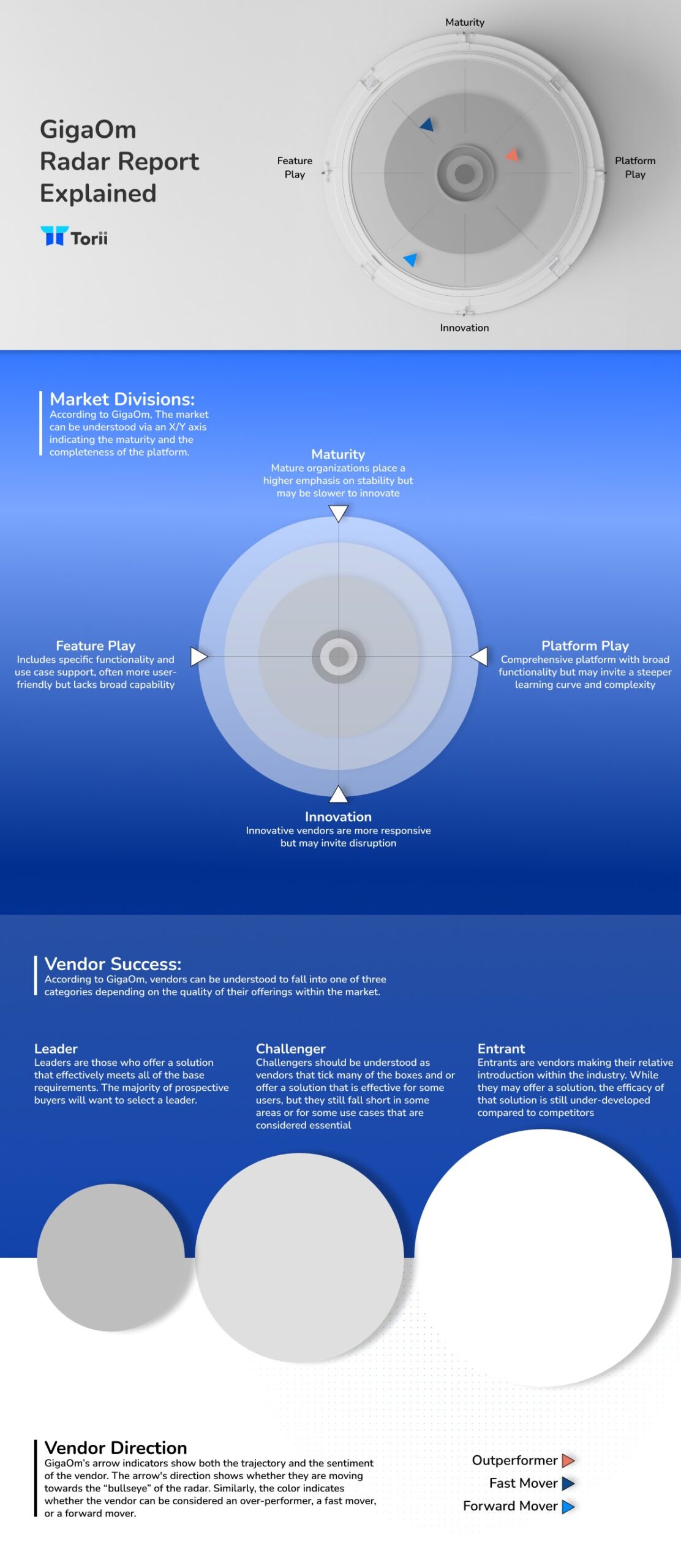

You can view GigaOm’s Radar on their research site, but here is a quick guide to help you interpret the findings within the report.

Vendor Insights

| Platform | Summary |

| Auvik | Strong in user access and license management but lacks deep integration with HR and finance systems, reducing overall operational efficiency. Ideal for MSPs needing network and SaaS visibility. |

| BetterCloud | Excels in user lifecycle management and workflow automation, yet historically lacks comprehensive spend and contract management features. Recently addressing this gap with BetterCloud Track. |

| CloudEagle | Offers extensive procurement support and innovative AI for contract management, but has limited out-of-the-box governance and sensitive data management. Best suited for finance and procurement-focused organizations. |

| Flexera | Provides visibility and optimization for SaaS usage and license efficiency, but demands technical expertise for advanced workflows and lacks granular security features. Better for large enterprises already using Flexera’s suite. |

| Lumos | Strong NLP capabilities for workflow automation related to employee lifecycles, but offers moderate governance support and is relatively new in the market, which may be a concern for some organizations. |

| Productiv | Strong in spend management and contract renewals with a user-friendly interface, but limited in sensitive data management, low-code workflow customization, and limited discovery. Focuses mainly on spend and user engagement. |

| Torii | Comprehensive features, such as strong discovery, workflow automation, and accurate usage metrics, make it ideal for SMBs and enterprises seeking a balance of spend and automation capabilities. However, it has a moderate focus on security. |

| Trelica | Provides broad SMP features with strong integration capabilities, but moderate in predictive analytics and benchmarking encouraging users to adjust spend forecasts based on expected usage. Suitable for organizations seeking a robust and user-friendly SMP. |

| Zluri | Extensive integrations and rapid feature development, but requires more time for feature quality assurance and lacks detailed spend benchmarking. Ideal for MSPs and large enterprises with significant SaaS integration needs. |

| Zylo | Excellent in spend and contract management with proactive savings recommendations, but moderate in sensitive data management and user engagement capabilities. Best for enterprises focused on optimizing SaaS spend and contracts. |

Conclusion

For prospective SMP buyers, the Radar Report provides excellent insights and criteria for consideration.

Ultimately, SMPs should be assessed based on their ability to optimize for the user’s desired outcome, whether to improve spending, manage security, enhance operational efficiency, or provide comprehensive integration coverage.

Another consideration is the level of vendor support. Check case studies and implementations, ask for references, and pay attention to the platform’s maturity.

The report also offers advice for enterprises, such as deciding if a full-featured SMP provides enough value compared to extending existing IT systems. Consider readiness and growth to avoid managerial debt during rapid expansion. SMBs should justify SMP investment by assessing spending volume, user engagement, and operational efficiencies while keeping future growth in mind.

Ultimately, selecting the right SaaS Management Platform (SMP) hinges on aligning it with your organization’s needs, ensuring comprehensive feature sets, and preparing for future growth. The GigaOm Radar Report offers valuable insights to guide this process, emphasizing the importance of a holistic approach and continuous market vigilance. Prioritize platforms that support digital transformation, scalability, and evolving operational demands to maximize long-term benefits.

The Radar for SaaS Management Platforms (SMPs) is available now.

About GigaOm

GigaOm provides technical, operational, and business advice for IT’s strategic digital enterprise initiatives. Their research helps enterprises modernize, transform, and successfully compete in a rapidly changing business environment. Learn more about GigaOm.

About Matt Jallo

Matt Jallo, with over twenty years of IT experience, is an expert in Cloud, Infrastructure, Management, and DevOps, and has held key roles at American Airlines and GoDaddy.com.